Here is a first world problem. If the Social Security Fairness Act increases my SS the way I think it will monthly, and I get a lump sum for 2024…this will put us in an IRMMA situation for just that one year. Do you think they will understand this…it’s the lump sum payment that will take us over.

And, keep up with it each year as so many details change.

It is worth an appeal; worst case they say no. When I appealed right after I retired, all I had to do was get a letter from my manager stating my retirement date. If you show them the documentation that this is a one time payment, they may adjust.

This is a very good article to give a snapshot of what people are thinking, and how much people are avoiding either getting a trusted fiduciary financial planner and learning important things beyond some basics. Various people had intention and also bits and pieces of doing some very good things. I found it interesting that there was no generational discussion outside of a parent having given advice that the pension (and also assuming in combination with SS) will take care of one in retirement - and two of the couples mentioned children, but maybe with the focus of this article, didn’t mention what lessons were being passed on. One parent had $100,000 in student loans, but her husband worked with her to pay that off.

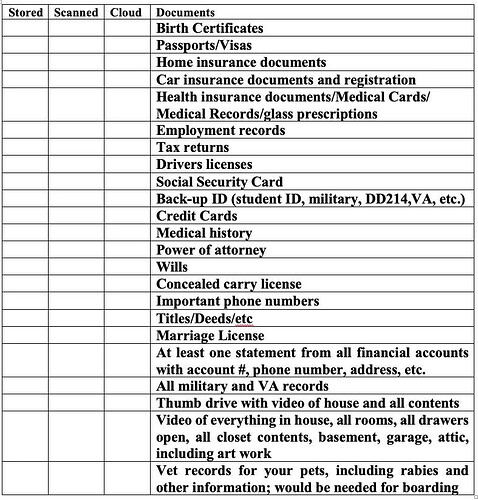

A list to kind of help with ‘documents’ - I saw this as to what you need if there is a natural disaster, but is also good for us all to have pulled together:

Very helpful list! And great idea to have the stored/scanned/cloud columns too.

I was listening to this, and he had some very good suggestions for preparing for retirement w/o proper saving but also gave some creative ideas which could be helpful for offspring (who are having trouble saving for a house or getting ahead financially). Very good suggestions on his recommendations.

60 Years Old and Nothing Saved for Retirement - Top 12 Recommendations

Thinking about The List more, I think we’ll do something modeled after it… but with a column over to the right showing the asset’s defined beneficiary (and alternates). That will give a checklist for verifying beneficiary setup is done and as-intended. It could also be useful ref for our kids once we are gone.

I’m concerned. I work for a public agency. That should be a good thing, but still concerned. I read the pension’s annual reports every year, but I’m not sure what else to do.

I’m ~14 years away from retirement, best case scenario. Technically, I qualify in less than 5 years to get a full service retirement (10 year minimum), but I want to hit 20 years in order keep our health insurance until we hit Medicare age. I feel like if I was retiring in 5 years, I would be more at peace, but because I feel like my Generation X folks are inheriting everything broken, on fire, and in need of complete rebuilding, I’m expecting more of the same here. I am obviously a glass half empty kind of gal.

My pension takes 11% of my salary, so it is not chump change. It is solvent now, but in 2022 the fiduciary net position was 92% of the total pension liability. In 2023, the fiduciary net position was 90%. In 2023, the rate of return was 4.25%. I got the same rate in my CDs without the administrative overhead, and they still aren’t close to 100% of total pension liability.

I would not be as concerned about the fiduciary net position as I would be with their rate of return.

I would check to see (or perhaps you have the information) on what your pension would be with the service credit with your planned retirement (working until eligible for Medicare). How this number will or will not change between now and your planned retirement.

Think about your current budget (income and expenses) and what else you can do to plan for your retirement fiscally. How you can do some different saving/investing within the current budget, what your plans are with property (planning to stay in the same home or what changes). Even saving/investing small regular amounts and getting better rate of return. If you are good with real estate changes if that fits what your plans are.

The advantage you have is you have some years between now and retirement.

Very helpful list. Videoing the house and all its contents would take a fair bit of work.

I think we should put the documents someplace safe. Do you keep these documents in the house or someplace else? I also think we should keep copies of each document someplace as well as electronically.

I read way more than I post, and I think I posted in the last thread, but we max out a lot of pretax space, too. One 401k, one 457b, and two IRAs. I was pleasantly surprised that I got to save $8k to DH’s IRA this week because he is 50 this year. Plus my 11% to a pension. We are both social security eligible and with the Windfall Elimination, I’m slightly better situated. We have 4x our income in retirement accounts, which is behind by general metrics for our age but I think my pension will help bridge any gap.

But still I worry because by the time I’m 62, there is no more on ramp. Also, I assume the market is not going to have the kind of gains it has had over the past two decades.

Plus we live in a VHCOL area. Our costs will go down because we won’t be saving thousands for college per month, and hopefully we’ll have a decade or more where those costs aren’t replaced with health care costs. Hopefully. But we have a modest home with a large mortgage, despite putting 20% down and having an historically low APR on our mortgage. We want to pass down a paid off home to our kids. Maybe we just can’t do everything, and I realize we are very, very fortunate in many respects, but I really worry about economic forces that I cannot control will turn sour or under-perform.

I am curious why you want to pass down a paid off home to your children? Do you think that they will want to live there as adults, or is it just the stepped up value of the asset you want to pass down?

Years ago we started ‘documenting’ purchases - just listing on lined paper. DH use to keep in a file in his office, but now it is at home (which would not do any good with a catastrophic loss/fire etc.)

I think videoing various rooms very carefully would be helpful - if you had a catastrophic loss, it would ‘jog’ your memory on details but also would be documentation for insurance purposes.

Documents that are electronic are easy to keep multiple places.

Some people purchase a small fire-proof item (safe or other) to retain the info like the room videos. I would consider where the best place to keep such a safe, and what size is based on what you want stored in it.

We live in an area that a tornado could produce a loss. A house in our neighborhood did get hit by lightning and had a substantial fire (people were not home at the time, and fire department was called by neighbors).

How about video and storing on the cloud? Lots of insurance - for claims - ask for video. It’s a quick way to document.

I applaud you for thinking about passing a major asset onto your children. We all don’t know if we would need long-term care/nursing home/skilled care which would potentially wipe out assets. Since you live in a VHCOL area, perhaps your children will have the opportunity to utilize your property if at least one of them lives in your area.

I want to encourage you that you need not worry about forces you cannot control - you are doing the things you can control. Having a faith base is a way we get through things we have no control over.

Passing the house from DH’s parents to their 4 sons was important to his mom - some of it was thinking that she could do this with their biggest asset and ‘leave her mark’ financially with the family. DH’s paternal grandparents were scraping by through life and later in life one son bought the house and the parents lived in a small apartment within the house - the dad lived a long life a few months shy of 98 in 1991, while his wife succumbed to heart valve issues due to probably strep infection w/o antibiotics available and was too sick for the rudimentary valve surgery in 1963 so she died at age 60. Part of DH’s mom thinking was also that her parents (DH’s maternal grandparents), who farmed (and the dad also ran a small cheese factory and also did welding work/repair of farm equipment) and raised 13 children were able to leave something for their kids – for the time, they lived a long life - age 74 and 83 dying in 1961 and 1974. DH’s parents signed over (title, deed) the house to the sons while parents were still living in it in retirement. Since MIL only went to skilled care for a few weeks until she died at age 92, some of her assets remained for inheritance including the house. A few months earlier DH’s dad died in skilled care at age 92. The house is still owned by family - and one granddaughter has bought in as part owner (her dad is maintaining the house) - various family members do use the house. Taxes are relatively low - just went up to $3,000. House is paid for, so just insurance and taxes.

My dad owned a construction business and then had excellent real estate/good cash flow - he died at age 64 in 1995, and mom lived to age 77, dying in 2010. Mom didn’t really spend down assets - she lived well and traveled some, and the last year or so had a live in housekeeper/cook as she succumbed to dementia but died very quick at the end. The five of us children did have a nice bit of inheritance.

Since DH and I have two children, in my mind we would like to be able to leave assets to children/grandchildren, but circumstances can potentially prevent this. We do have LTC insurance policies, but if one of us has a long stay in skilled care/nursing home, it would eat away assets. We have started contributing to a stock fund for each of the grandkids (and will put in for #5 after born and obtaining SS number).

A couple of reasons. Our state has a very compelling tax system for inherited properties. A number of families we know who are living in the house their parents bought and paid off have enormous flexibility with their lifestyle. I also think this area is highly competitive for the job market and will remain so for my children’s lives. Even if they do not want to live here immediately, they could have the option and in the meantime, rent it out for a tidy profit. We have to live here anyway until our youngest (D30), finishes high school, so another few years of mortgage payments I think is worth the long-term benefits to our kids.

Thanks for the explanation. I didn’t think of state tax considerations, but the step-up in basis upon death is definitely a huge federal tax savings.

We had our children later in life (we were married for 15 years when we had DD1, and DDs were born the years we turned 38 and 40). We did start the college savings process when they were infants - so it would not drain any funds from retirement. It turns, out for a time, our state had a pre-paid college tuition program which we bought in up front. It paid for 135 hours at any state CC or public college; it was a ‘good deal’ for us because we used it as intended. If your student went out of state or to a private college, it paid the average for the state schools. The state did dump more money into this tuition program to keep it afloat as investments did not keep up with tuition costs - and then they froze what tuition amount would get paid out (actually went to state supreme court to argue that it was not a state backed obligation, and this was the compromise). DDs both had scholarships at state schools (UA and UAB) so this program was ‘stacked’ with paying for dorm or other expenses, and student received a refund when living off-campus. We also had a stock account for each DD, and when my mother died, she left two small insurance policies to her grandchildren as beneficiaries. So DDs got a ‘boost’ in their stock account. Any money left in stock account could be used by DDs after graduation - one had thousands of dollars left while the other had a few hundred dollars left, but both graduated from college debt free. Older grandchildren used money differently - one had graduated and used the money to assist with home purchase; one purchased a better car; one used for higher ed; one was in college so for current expenses; a few IDK but the money came in handy.

Neither DDs will ever live in our city, or highly unlikely - so we are trying to figure out best timing when we are ready to move out of the area. I anticipate we will be here probably another 10 years, but really as soon as DH’s hobby activities tied to this area sputter out, I will be looking to move proximal to where DD1’s family is in TX (we have lived in TX before) - the grandkids are plentiful there (#5 to be born March 2025). DD2 is in FL and is single with long-time BF (but has said she wants to have children later in life like DH and I did), and DH says he does not want to live in FL. DD1 turns 31 next month and DD2 turns 29 in March. Our primary residence can possibly be elsewhere, but not ready to really speculate as so many things can change between now and then.