Yes.

I think the significance is how employed vs. self-employed are treated. I’m not complaining as we are solely in the employed category, but a few years ago I was self-employed, putting a hefty penny into my private retirement. I’m also delighted that FSA numbers aren’t added back in - another nice benefit for us who max it out every year.

The asset protection update may well have an impact on your estimated SAI, which could possibly be reduced when the final SAI is calculated. Hang in there.

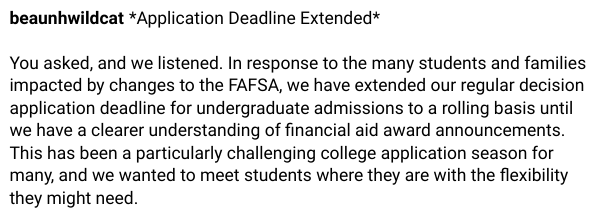

Via Instagram, UNH extends RD application deadline to rolling:

![]() that is scary

that is scary

When something is a completely foreign concept, it can be difficult to understand. As surprising as it was for me to see how people misunderstood things related to financial aid, it actually made me stop and think … how should I best communicate this to someone who doesn’t know what I know?

Fun fact: SAI/EFC now has an extra digit, so if they think like that, imagine what they think when they see an SAI of $999,999! “Oh no, that’s a lot, how will we ever pay it?!” It makes you wonder how someone who thinks like that could get so wealthy.

And we do appreciate all your help and patience with us!

Neither of my boy’s 2024 SAIs had an extra digit? I have not heard about this. I know last year and the year before the numbers began with a zero (if I remember correctly).

Did the extra digit start in the last week or so? We did ours 1/3

It used to be that the highest EFC one could get was 99,999. It’s now 999,999. Meaning that really, really rich people whose financial situation hasn’t changed can now get an SAI of 999,999 when last year it was limited to 99,999.

Then your SAI was less than $100,000.

Starting this year, SAI can range from -1500 to 999999. I guess they don’t display leading zeroes, e.g. 1635 rather than 001635 (with or without $ sign).

thank goodness!

I guess as problems go, it’d be a good one to have.

Suggested timing for filling out FAFSA, knowing that our CPA is amending our 2022 return in mid (15-20th-ish) February? My husband discovered that his beloved bookkeeper was off her game and failed to record $60-70K in expenses in 2022. He has told me to expect a big amendment to our 2022 return as a result. I have hung back from doing anything FAFSA-related for my 2 remaining college students so far. They go to a pretty “gentle” state flagship school that I’m sure will keep extending the heck out of its priority deadline. Ordinarily I would wait till 3 weeks after submitting a 1040 amendment to use the IRS reconciliation tool. Everything will be way easier and smoother if the amendment has time to “hit” the IRS and get processed before we sign on to 2024/25 FAFSA. Do y’all think FAFSAs submitted in mid-March are likely to process faster and smoother than the ones from this last month? And does anyone have any insight on how the IRS is running with prior prior year amendments right now? TIA!

I actually wish my SAI was $100000. It would mean I had a heck of a lot more money.

I just realized you were talking about the extra digit at the end of the SAI rather than the previous year’s 0 at the beginning! Sorry for the confusion. Having a six-digit SAI wouldn’t be the worst problem, I suppose!

Hi @kelsmom , for my D24 one of the school which defferred from EA to RD have asked us to submit income/expenses declaration form for the year2022.

My question we are from Canada , do the amount should be converted from CAD to USD ? Or we can just put CAD amount?

There is no field mentioning on selecting the currency.

Please help us

My D is US born has dual citizenship and we parents are non-US Canadians.

For FAFSA, they want the information to be in Canadian currency (a change from the past, which wanted it to be converted to USD). I would send it in CAD, noting that fact.

Yup! Except my son’s email said I didn’t sign! Which I totally did!