Yeah definitely, I don’t think I need a lot of persuasion to go to Carleton, just something my parent has brought up and something I’m also worried about is job prospect. Maybe if I majored in CS at Carleton, but CPP seems like a very good hands-on and known school for engineering. My fear at Carleton is not being sure of my major, choosing a terrible one and then not being able to pay my loans off. No one can make the decision for me, but it’s really something that’s scaring me off. I don’t know for sure what I’d do at Carleton since they don’t offer engineering, and I’m scared of “exploring” because it’s still a good bit of money.

Do you want to be an engineer, or are you interested in it just because it seems like a field that you’ll be able to find a job upon graduation? If you want to be an engineer, don’t go to Carleton.

If you’re not sold on a future in engineering, then look at the resources available at Cal Poly Pomona and at Carleton to see the ease of advising, utilizing the career center, connecting with alumni, etc.

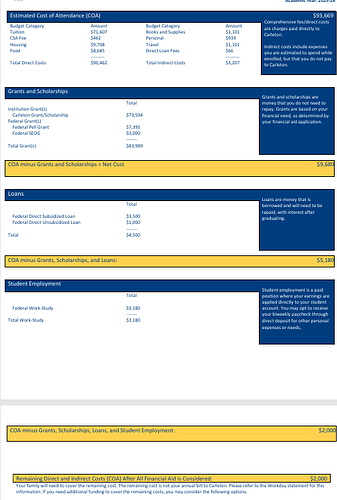

I did some of the work for Carleton for you:

Look through the information on academic advising and see if you can talk to students who started off as undecided and what kind of usefulness they found in the academic advising on offer.

Look at the resources for the career center, too and talk to students about how useful they’ve found it.

Carleton also has this Pathways program that lets you see what alums majored in and what field(s) they’re in now, and, if you’re in the Carleton system, the names of those alumni to connect with them.

My 2 cents:

I wouldn’t say wanting to go into engineering necessarily rules out a college that doesn’t offer it for undergraduate study. Anecdotally, some of the most successful engineers I’ve known did their undergraduate work in the natural sciences. That’s not always ideal if someone wants to earn a professional engineering license as soon as possible, although most engineers don’t have those (~20% is my understanding.) The licensure route can be shorter with an ABET certified undergraduate engineering degree, but even some schools with great undergraduate programs in aerospace engineering don’t have ABET accreditation for them (eg, Stanford), implying licensure is not as significant a barrier in that particular field as perhaps others (eg, civil engineering).

Less anecdotally, and at Carleton specifically, it appears from this page that between 10 and 15% of their physics majors go into engineering (depending on which table one looks at.) As a caveat, I don’t think that page captures more than ~1/3 of their majors for the years in question, and it appears it hasn’t been updated in a few years. Also I don’t see “aerospace engineering” explicitly mentioned.

For another data point, Carleton and some other LACs do manage to send more students into engineering PhD programs than might be assumed, at a higher rate than some excellent schools with undergraduate engineering, in fact. Given the selectivity of funded PhD programs, it seems likely they also have success with MS engineering programs.

That said, I think both options are great! Congratulations and good luck OP!

If Carleton is going to cost your parents $2000 a year, that’s fabulous.

I’m very confused. What is your total net cost right now to attend Carleton?

I read it as less than $4000 after loans and student work. See post #14.

If there’s new info (Dad just lost job) that could be the basis of an appeal.

Reach out to Carelton financial aid. Maybe they can do something for you and your twin!

This sounds like a great offer, if you can just make the finances work.

I believe OP stated on their other thread that they had an appointment scheduled with Carleton FA. Hopefully they’ll post an update.

2k parent contribution, 3.5k in subsidized loans and 1k in unsubsidized loans, and 3.1k in work study. That would’ve been an extremely reasonable price if my dad were still working and I didn’t have a twin.

You should be able to get $2000 total in unsubsidized Direct Loans.

@kelsmom am I correct about that?

Also, do you have a weekend or after school job NOW, and for the summer. That can be used to offset your costs for things like books and travel…and your personal spending.

Really trying to, dad will not drive me nor let me get my license, so I’m trying to find a job I can walk to. Definitely will put more effort into that.

Yes, you can request an additional $1,000 unsubsidized loan for a total of $2,000.

If you end up at CPP, how will you commute? Will you be getting your drivers license for that?

And insurance for new drivers is very expensive. Likely more than the $2k you will need for Carlton.

That’s a good question, I don’t know. He’s against me getting a license because I can go to places other than where he wants me to go. Probably will drive me there a couple times, get sick of it and let me get my license.

Based on what you have posted, it really sounds like Carlton is the better choice for you.

It looks like Carlton will cost $9.6k a year. (2k parent contribution, 4.5k in loans and 3.1k work study).

You need to know the following things:

-

Tuition is not due all at once. Usually they ask for a deposit in May or June (often around $300 or so), and then you pay for each school term before the term starts. Since Carlton is on a trimester system, they want payment on 8/15, 12/15 and 3/15. This is great news for you, because it will give you time at your work-study job to earn money for the 12/15 and 3/15 payments! (Work study is not applied directly to the tuition – you have to work for it and then apply the funds to the tuition at a later date).

-

as posted above, you are eligible for an additional $1k loans, which I think you should accept. Once you start working, it won’t be too hard to pay that off.

-

Anyone can pay the parent contribution. If you have savings or can work this summer, you can pay that amount.

So…Carlton will ask for 1/3 of the $9600 on 8/15, which is $3,200. They will also credit you with 1/3 of your loans at that point, leaving a balance of $1,400 you have to pay by August (possibly less, depending on how they apply the deposit). Can you pay that out of any of your personal savings or any work you can do between now and August? Or ask other family members for help?

Then in December, they will bill another $3,200 and apply another 1/3 of your loans, for another $1,400 balance. But at that point you will have hopefully been able to earn 1/3 of your work-study allocation, approximately $1,000, leaving a balance of approximately $400. You can hopefully also work off campus to earn that $400. Repeat for the third trimester.

So you very well may be able to do this without parental money at all.

Also, it may end up being even less expensive than calculated, because I truly think your expenses are going to be about $1,000 - $1,500 less a year than anticipated, because the costs are based on a books and personal costs allowance of $1,876 and most students can and do spend much less than that.

And there are costs to staying at home and going to CPP – food costs (quite considerable) and commuting costs (also very expensive). I really think Carlton will end up costing less than CPP when you take this all into consideration.

Asking @kelsmom and @thumper1 to make sure my assumptions are correct.

CPP aid came out and it’s nothing like the calculator, really don’t know how to feel about this lol.

Can you post the Cost of Attendance that they should have also sent you?

(also Carlton’s if you have it).

Wait yeah, wrong thing.. drumroll please. Even if I live off campus, it’s crazy!! For some reason I’m considered an OOS resident, so this might be part of the problem. I’ll try to fix it and see.

The Carlton COA is very helpful.

See the section in the upper right, for Indirect costs of $3,207? That is money that they will not bill you – it’s just what they assume you might need/want to spend for the year. You won’t need to spend that much. Books usually come in at a lot less, especially if you buy used or rent them. Let’s be super generous and say $500 a year, since Carlton is on a trimester system you may need more books than a semester-based school. You can spend almost nothing on personal items – maybe toothpaste and similar supplies. And you could probably travel home two or three times a year for that allocation – check kayak.com for cheap flights to see. So if we say $500 for books and $500 for personal expenses and $900 for travel, that’s $1,300 you don’t have to come up with. And if you spend less for travel or personal expenses, that’s an even bigger savings.

You CAN make Carlton work – and I really think you should try to do so.

Let me know once you get CPP straightened out!

Editing to add that although they are not billing you for those indirect costs, they are being included in the COA as if they are being billed. That is, the $2k remaining cost line is there with the assumption that you will pay for all of those indirect costs —even though you don’t have to if you live frugally. So that $2k may really bump down to less than $1k.