Even better news! My mom has stated they will contribute more- they spend $6000 a year on my travel volleyball and will now funnel that money towards college bringing their contribution to $21,000 plus my potential $5000 if I cash in some bonds.

Then add W Carolina

That’s really good! Congratulations on discussing the matter with your parents and on such good news.![]()

![]()

Add 5.5k in federal loans (the maximum you can get as a freshman) - you’re now 7k away from being able to attend Furman. Time to look for a job!![]()

I hope you do apply to Hendrix and a few others listed before, just in case Furman doesn’t work out.

Wondering if you might like Sewanee - run rhe NPC and if results seem within budget (25-35k) perhaps reach out to see if they’re still accepting applications (say your financial parameters have changed hence the late inquiry).

WCarolina is a good suggestion if you want a Southern safety.

Baylor, for instance. $45,000 - 21,000 parental contribution. You have $24,000 left over. Take 5500 in student loans and you have 18500. $5000 in bonds, you have 13,000.

But…University of Tampa is about $13,000 cheaper. You can afford that school. So, it looks like all the schools in the $30k range are affordable. Just be sure to work your hinny off this summer to pay for books and whatever tuition is left over and you got this. Good luck!

Or go to a southern miss or W Carolina or the other two NC Promise schools with $5k out of state tuition.

Western Carolina University - NC Promise: Use Your Advantage.

It’s great that you and your family are having these financial discussions so that you can have greater clarity on financial options. So right now it looks like budget is $21k from your parents plus $5k from the bonds for a total of $26k. If there was a particularly stellar match, I could see taking up to the federal loan amount, but I’d really try and keep it under the $26k. There are a few things you and your family should keep in mind.

At almost all colleges, the cost of tuition and fees (and other expenses) will go up annually. So what costs $26k in your first year will probably be more like $27,200 in your 2nd year, $28,500 in your 3rd year, and about $30k in your 3rd year, if the college limits itself to a 5% annual increases (and colleges have definitely been known to raise their rates faster than inflation). So, you’d somehow need to find an extra $4k more/year for your senior year in college than for your freshman year. The question is…where is this money going to come from? The likeliest options are:

- Federally subsidized loans

- Your employment

If you’re already using loans and employment money to pay for the costs of freshman year, how are you going to get the additional funds for your later years? Also, if you and your family are really just covering all the financial costs of tuition & fees plus room & board, don’t forget about books, travel, regular expenses (like medications), and any spending money you might want. Those are the types of expenses that I think are more reasonably allotted to something like a job while you’re in college.

Additionally, there could be changes in your family’s financial situation (job loss, reduction in hours, needing to help assist grandparents financially, etc). If your family needs to cut back on their own contributions, your employment or federal loans can serve as a financial buffer (rather than being unable to continue and needing to drop out or transfer partway through).

So, right now your budget is about $11k more than you thought it was a couple of days, which is an AWESOME place to be. That means that a great school like Hendrix would be affordable with no loans. There are other options as well that were mentioned upthread. If there’s a college you’re interested in that doesn’t have a chart with scholarship amounts, then run the Net Price Calculator. If it asks for your academic stats, then it is providing an estimate of the minimum amount of merit aid you can expect if accepted.

Which other schools are you thinking about applying to?

I liked what I saw for Souther Miss, Western NC, and Hendrix so I think I will do those three. I liked the TX ones but most likely won’t be able to fly out to visit before May with my volleyball schedule…the others are can see when I am down that way for tournaments.

When I visited Florida Tech they gave us a projected 4 year tuition increase but they said most of it gets offset by the lower meal plans because the suites will have full kitchens in them to cook. I know TCU increased tuition by 7% this coming year so even if they were affordable that kind of scares me lol

The suites only help lower the costs of food if you actually COOK.

Most kids I know who move off campus- yes, no meal plan- but they are doing Uber eats or restaurants or even supermarket takeout every night (and sometimes for lunch, plus Starbucks for breakfast) and before you know it they are spending MUCH more on food than they were living in a residence hall with swipes and snack credits.

I’d really dispute the claim of “most of it gets offset”. Every parent of a current college kid who has moved off campus that I know complains constantly about the food budget or lack thereof. The kids aren’t going to the grocery store to buy dried beans and pasta and fresh spinach to make healthy dinners-- they are ordering out.

This is why we get my daughter swipes.

She says it’s embarrassing as a Junior yet uses them all.

You are right - they don’t cook. Many of them anyway. My son yea. My daughter has the phone attached to her head too often to do so.

Sidenote: learn how to cook 5 easy dishes you enjoy eating before you leave for college.

Your dorm may have a kitchen and teaching cooking will make you hugely popular. (Not to mention knowing how to cook will make your life better).

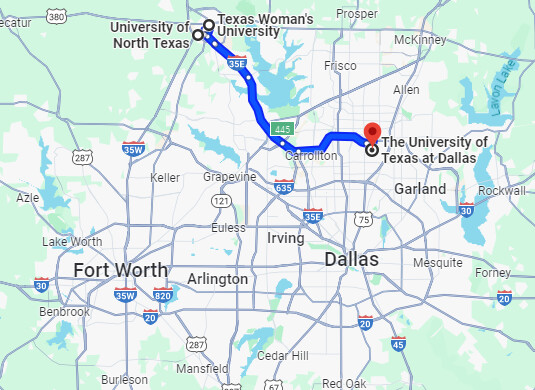

Even if you can’t visit before May, I would still give strong consideration to throwing an app to the Texas schools you were considering before (and Texas Woman’s which is in the same town as UNT). Dallas/Fort Worth is a big airline hub so you can get frequent and cheaper flights from there and you could see what the financial package comes back looking like. Plus, a number of schools have started to push the response deadline back from May 1 to June 1 because of the delays in the FAFSA rollout. If you get a Texas offer that you like, you would (potentially) have the entire month of May to visit.

Maybe my kids are unique (or grew up eating home cooked meals) but they very rarely ate takeout when they were off campus. Dd21’s friends would ask why she wasn’t ordering chipotle, she would explain she didn’t want to pay for it. It helped a lot that my kids really like to eat healthy, when home over the summer they pack super clean lunches every day for work/clinicals/internships. They work in college to pay for rent and food, they’re not doordashing.

That’s a generalized statement that honestly doesn’t apply to me. My mom is a fantastic cook and has taught me and my sister. I have never used door dash or uber eats and actually enjoy cooking and would love to be able to cook for myself.

My sister has lived off campus for 2 years and has paid for her own groceries. Sure she occasionally goes out to eat but generally cooks everything herself.

Ohhhh that’s true! Thank you! I will research them more!

My mom made my sister a cookbook of all her favorite meals and a bunch of easy ones!

Terrific. Then you will likely save money living off campus.

What an awesome gift to share! ![]()

![]()

No Trader Joe’s, Costco or Aldi in vicinity? My oldest DD is leaving out of deep freezer with food from above plus fruits and veggies for 4th year no problems. No big bills. No daily runs to Starbucks.

Youngest loves smoothies - make runs for big packs of frozen berries at Costco.

Nobody expects a student to make Ravioli from scratch. But they are available in any store…Big can of Nutella, crackers, eggs, milk, cream cheese, cereal and fresh berries and you always have good option for breakfast. ![]()

My 2 kids hate meal plans and we run from them as fast as we could.

I’m not sure if this will change anyone’s opinion on University of Tampa, but I got invited to the Honors Program yesterday.

Application for Western Carolina submitted! Using the most expensive dorm and meal plan it comes in at under $21,000 per year…and I watched some youtube videos and videos from their website and I could see myself fitting in their perfectly! I hope I am not too late with my app since technically it closed Feb 1 and said anything after Feb 2 would be considered if space allows. We’ll see! Thank you everyone who suggested it!