I’m taking SS at 62. I see no reason to wait. I’m single, so no spouse to get my benefits. My SS ends with me. Since I don’t need SS payments to fund my retirement, I’ll happily take my “gravy” as soon as I can. The “math” doesn’t matter to me, as it’s speculative.

I will go with the person who knows our entire financial situation as well as our financial goals and plans. I stated what we did, I did not ask for advice.

Thanks anyway.

Putting off SS for H and I until we are both eligible for Medicaire. This way we have low income and pay less for our marketplace health insurance plans.

The SS discussion reminds me of what I told my dear bff recently. She wants to take her SS now, well before FRA, so that she can retire. I am holding off as long as I can. Neither of us can be certain that our approach is “correct.” They both are driven by fear (you should know that I think 90% of everyone’s decisions are fear-based; it’s a matter of figuring out what we are afraid of).

Anyway, her parents died in their 80s, including her mom just last week, and her in-laws died in their 60s. Her dh is several years older than her and already has lived longer than either of his parents. She is afraid that they are saving money for golden years that may never happen. I get it. However, my dad died at 91, and my mom will be 92 soon. I am afraid that my money will outlive me and that we’ll be a burden to our kids. So, yeah, I’m letting that SS max out as we don’t need it now.

I get it that, mathematically, there is one right answer that we will have more money at, say, 85, waiting to take SS than if we took it early. But making it to 85 isn’t promised, so I see my friend’s POV as well. We are all trying our best.

I’m assuming you know this, but you can both not work and not claim social security at 62.

Something some people may not realize is that if you have a part-time retirement gig, and make over a certain amount of money, while taking SS and being less than full retirement age (for social security purposes), for every couple of dollars you make, your social security payment is docked by a dollar.

Yep, I am just looking forward to not working at all. If I could quit today I would.

Mathematically we could all optimize the SS decision if we know our “end date”. Nobody does, so it makes sense to decide based on the factors you known… and what you fear most.

Yes, knowing our sell-by date would make this so much easier. ![]()

and you can model the big the unknown, i.e, your end-date. (open social security does this quite well by mortality-adjusting the cash flows by year)

It’s not perfect but in my opinion you can look to family history and genetics to gain some insight into a possible “end date”.

In my opinion, if your parents both lived into their 90s, the odds are in your favor to also live a longer life. If your parents pissed away close to 70 then perhaps you won’t live such a long life. In many cases there are trends in families that could be looked at. Perhaps the men seem to live longer than the men. Or the men generally have heart issues. Or the women tend to develop cancer. Etc. It’s far from perfect but it might be more accurate than an average generated across society by an actuary table.

In the end no one knows and it’s just a guessing game but perhaps you can give yourself a slight advantage by looking at family history to give you some clues.

You are right on the speculative aspect - the ‘breakeven’ point happens at a specific point, but one can live a short life in retirement or a longer life. Some want to spend on the ‘go go’ years, and use the ‘gravy’ as soon as it comes in. Some people’s jobs get so wearing on them that it indeed affects their overall health and well-being, and stopping work is a big plus for them.

Since you are single, that is another factor in your decision making - you don’t have changes outside of yourself affecting retirement like those of us with spouses (and then potentially have a significant change with death/disability and the financial consequences).

What is the financial risk factor coming in - age taking social security factoring in your other finances.

Most people on this thread have set things up to not run out of money in retirement, as much as can be planned. Of course we all know relatives/friends that carry out thriftiness beyond their means due to life experiences, or they just can’t or don’t want to adjust their way of life to spend some of their money to make their life easier or improve QOL.

We ran several calculators and got different times for when I should take my ss. My DH, who is several years younger, is waiting until 70. I chose to take it at around 67.5 as I wanted the play money after I retired and financially it makes no overall difference in our picture when I took it. So personally I wanted the small income stream, and it also means with the extra cash flow, if we have overage in the checking account my DH invests it (and does better than 8%) and with the extra monthly money we only episodically need to pull cash from investments for large expenses. So more money stays invested and is earning generally quite well. I think I also calculated that my “break even” number was 18 years from when I started to draw, so I still have many years to go.

If I look at my parents, I don’t have many years left. However, I refuse to limit myself by the life expectancy of my parents. My life has been easier than theirs in many ways, and I pay closer attention to nutrition and exercise than they did. They had health issues during their lifetimes that would be handled differently today. So I plan on 95 when running retirement calculators. If I don’t live that long, I won’t know the difference. Obviously, if taking SS earlier was necessary in order to make ends meet, I’d have to take it earlier. As it is, I am fortunate to be able to have a choice.

Same here. And it is definitely a blessing that most retirees (who are sometimes layoff victims) don’t have.

This!

Life expectancy is part genetic, and part luck, but a large part is lifestyle.

Advancements in medicine is a big help with longevity! Plus less dangerous work environments and although different kind of body stresses, one can have a better quality of life.

The cholesterol control medications, the advancements with cardiology (meds, surgery, lifestyle) are a few key ones.

The fact that here are less people who smoke probably also helps with longevity.

That is lifestyle. Along with diet and exercise.

And modern medicine.

My husband’s grandmother died of cancer, his aunt died of cancer, her daughter died of cancer. My husband carries a gene.

Our daughter’s cancer is treatable now. And this horrible legacy will stop with her. Because they can test her embryo’s. And we know her brother doesn’t carry the gene. So it stops in our lifetime.

Modern medicine is an amazing thing.

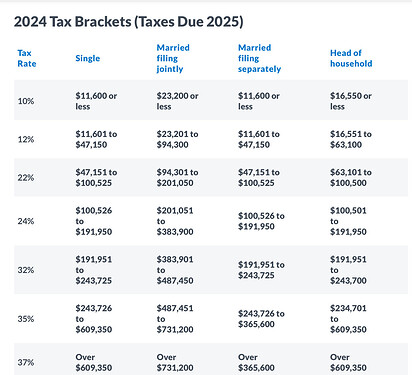

For folks considering Roth rollover and other tax planning, below is 2024 tax rate chart. And IRMAA brackets (relevant for those who are on Medicare now or will be by 2026). Standard deduction for 2024 will be $14,600/single, $29,200/couples.

Note: discussion follow on IRMAA caveats 2024 vs 2026 etc

Based on above, you can see why retirees avoid doing whopper Roth rollovers…. plan it out over time if there is risk of tax/IRMAA penalty.