Many employers have really no loyalty to employees, and expect employees to be loyal to them? DH survived many layoffs; in the end, he left/retired earlier than we planned because he hated his boss. DH could have worked 30 hours/week and each week emailed a list of what needed to be done yet (his boss was non-engineer plant manager) but that wasn’t his style. Every week put up with unrealistic demands/pressure until he realized we had plenty of money. I was able to save money ($1,000/month) by being able to pick up my employer’s health insurance which was similar to what DH had (I worked enough hours to qualify), versus using 11 months of COBRA. DH had over 35 years with the company (actually company bought out a series of time, but he had the same phone extension in the same buildings). His last 11 years, pension was cut out with new owner (had several pension ‘payouts’ in the past - stock and some cash. Some years little or no pay raises. More work/responsibilities with less people capable. In the end, DH was the lone person among several facilities (electronic contract manufacturing) who knew how to do many things. Saved major contract at another plant as he ‘fit the bill’ of being a senior test engineer with government electronics manufacturing experience - he was at the CA facility when the contract specifications were being ‘sweat out’ by the plant manager who did not know DH’s full capabilities. DH asked him what his problem was, when he knew something was up. Plant Manager was floored when DH became his ‘savior’.

Also for us, letting our 2.5% interest rate on our home mortgage (payoff Mar 2032) continue - we plan to both be living and fully capable at that time, age 75 for us both.

A Huge Number of Homeowners Have Mortgage Rates Too Good to Give Up. On a scale not seen in decades, many Americans are stuck in homes they would rather leave.

April 15, 2024 NY Times Article A Huge Number of Homeowners Have Mortgage Rates Too Good to Give Up - The New York Times

"Something deeply unusual has happened in the American housing market over the last two years, as mortgage rates have risen to around 7 percent.

Rates that high are not, by themselves, historically remarkable. The trouble is that the average American household with a mortgage is sitting on a fixed rate that’s a whopping three points lower."

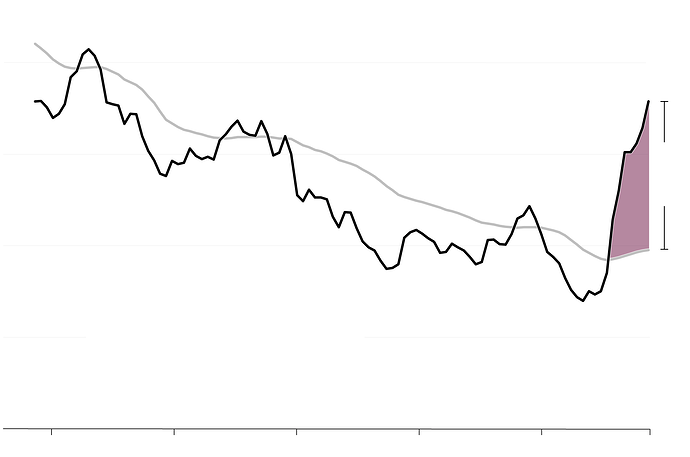

“Rates on new home loans now far surpass rates locked in by Americans with existing mortgages. (Article included this Chart that I could not copy in entirety)”

Source: Federal Housing Finance Agency analysis. Note: New loan figures show the predicted rate that existing mortgage holders could get on the same mortgages at new market conditions.

"The gap that has jumped open between these two lines has created a nationwide lock-in effect — paralyzing people in homes they may wish to leave — on a scale not seen in decades. For homeowners not looking to move anytime soon, the low rates they secured during the pandemic will benefit them for years to come. But for many others, those rates have become a complication, disrupting both household decisions and the housing market as a whole.

Indeed, according to new research from economists at the Federal Housing Finance Agency, this lock-in effect is responsible for about 1.3 million fewer home sales in America during the run-up in rates from the spring of 2022 through the end of 2023. That’s a startling number in a nation where around five million homes sell annually in more normal times — most of those to people who already own.

These locked-in households haven’t relocated for better jobs or higher pay, and haven’t been able to downsize or acquire more space. They also haven’t opened up homes for first-time buyers. And that’s driven up prices and gummed up the market.

Another way to state how unusual this dynamic is: Between 1998 and 2020, there was never a time when more than 40 percent of American mortgage holders had locked-in rates more than one percentage point below market conditions. By the end of 2023, as the chart below shows, about 70 percent of all mortgage holders had rates more than three percentage points below what the market would offer them if they tried to take out a new loan."

Later in the article this is stated “Professor Fonseca estimates that locked-in rates are worth about $50,000 to the average mortgage holder. That’s roughly the additional amount people would have to spend if they swapped the existing payments left on their current mortgages for higher payments at today’s rates.”

There was some discussion about this on another thread about the expense of home renovations. People are staying put with their cheap mortgages and renovating their homes.

We eventually want to sell our paid-for NJ house (1 hour from Manhattan) and buy a 2 br condo outright with no mortgage approx. 1 hour north of Boston. NJ housing is expensive and normally one would leverage that to buy a cheaper and nicer place in a warmer climate, but we want to be near our daughter and her family, who live in MA. The real estate markets (where we live vs. where we are moving) are largely comparable. My fear is that the market will freeze up b/c of high interest rates and we won’t be able to sell our house for what we would need to buy what we want in MA. I do not want a mortgage in retirement. It is a psychological thing.

Same. (Though I know there are different approaches and don’t blame anybody wanting to keep a low interest mortgage.) Interestingly, though we’ve been buying cars with cash for 30+ years it’s crossed my mind that someday we might consider leasing or low interest loan deal in retirement. That would smooth cash flow needs.

Same. We have always bought cars with cash outright (either used, or new) and driven them until they died. But some of the leases are pretty attractive. And also, I don’t know how much longer I will be driving (although I know it will be for a while). Our vehicles, which we own outright, are 2 and 8 years old and they are very sturdy, cared-for and in excellent condition (Toyota and Honda, expect 200-300k mileage), but when they finally die in a decade or two, it might make sense to lease one vehicle (we probably won’t need 2 at that point).

Houses in my local market are going over asking because there is no inventory b/c the present owners cannot find a new house to move to. This has halted the entire market: trade-up, retiree downsize, and younger people trying to move out of Manhattan or Brooklyn.

I assume you want to find the place in MA before selling in NJ?

Ideally yes. I would like to identify our place in MA, bid, then sell. But I don’t know if this will work.

NJSue - I have the same plan - eventually sell our largish suburban home in a great school district and downsize to something we can buy outright.

Agree with you and Colorado_mom - just want to make sure i have paid-for roof over my head when older (and an asset than can be - I think? - shielded if one of us has to go to assisted living).

I also see the paid-for next house as something we can pass on to our kids some day, which they can then sell or use (as my parents did for me and my brother).

The generational wealth part is why i am leery of buying in FL or other place subject to severe weather changes in next few decades - want that valuation to be as stable as possible and don’t want to loose it in hurricane, etc…

I don’t particularly want to retire to a vacation area. I know that “real people” live in Florida year-round and it’s not all tourists and snowbirds, but I would prefer to live full-time in a place where the economy does not revolve around tourism and leisure. It’s just a different vibe. I know some people dream of exactly that and for them it’s paradise, but for some reason it’s offputting to me. I also want a 4-season climate. I hate heat, and fall is my favorite season.

And living in an active retirement community makes me think of high school (I hated high school). But I have friends who love it, and I am sincerely happy for them to have found their happy place.

There are a couple of 55+ communities around where we live, and we know people who live in them. The advantage of such communities is that you have a built-in community of people at the same stage of life as you who are looking to make friends and connections. When we move, we will need to construct a life and can’t rely totally on my daughter’s family for our socializing needs. So I kind of see the appeal of the 55+ community. On the other hand, I don’t know if I’d like the HOA aspects or the social segregation. It’s a mixed bag. I do know that I want to move to a continuing care community when I’m in my early 80s (if I live that long) to spare my daughter anxiety. My father should have done that. So I am willing to buy a normal open-market condo to live in for 15 years or so and then move to a CCRC, which would provide the fellowship that a free-standing independent situation would not.

I am open to a community situation when I’m older. I think that it can be a good idea as health fails and friendships fade (or friends die). What I don’t want is the kind of “active community” some friends have chosen. They are engaged in what TO ME feels like a competitive lifestyle - and always at everything, making sure that they are in with a particular crowd so that they don’t miss out. I am active, but I’m also introverted.

I am the opposite. I retired to a tourist town. I like living in a vacation town. Tourists are there to enjoy themselves. I like to see people relaxed and having fun. There are decent restaurants. I can eat out and there are other amenities that wouldn’t exist otherwise.

A chacun son gout! It’s all good.

I do know that I want to live in a place where there is sufficient population density to support an array of services and entertainment options. These places are on the expensive side, whether they are tourist-dependent or not. I live on the Jersey Shore and I feel we are in the sweet spot; we have a lot of restaurants, bars, festivals etc. that are tourist-dependent but we also have enough year-round population density to allow business to make it in the off-season. Too bad we can’t stay here.

We downsized from NJ to MA last year. We are renting in a 55+ building which is part of a bigger community (with all ages). I socialize with people in the building, who are close to me age. However, I have found more connections with people I have met in other places. For example, I have friended a couple of librarians in town who are around my daughter’s age. I don’t limit myself to looking for people my age as friends, but rather people with common interests. I meet people of all ages at yoga class, book groups, etc. I definitely do not rely on my nearby daughter as my only social activities.

I want a place where I can afford to live, I have good access to medical care, I have access to the arts… music, plays, dance etc. that is reasonably affordable, I have a opportunity to meet friends and finally has access to reasonably affordable airfares so I can travel when I wish. It’s not a place most people would “retire” to but in my opinion I live here now. I am content.

I know several people who have retired to ‘college towns’ - be it state flagship type schools or where there is one or several small to mid-sized private Universities. One moved and settled into a home (no downsizing, but no lawn care and no snow shoveling in their MN detached but what we would call zero lot line home - they only care for a foot beyond their home walls), and now her DH has Stage IV cancer and most likely less than a year to live. Their son is getting married in a few months not far from where they are living; their daughter/SIL got married a few years ago and have twin sons states away – she has driven several times to DD/SIL/Gkids (overnight hotel with travel). We are close friends; will see what the future holds - I suspect she will stay in home/location for a while, probably many years until she makes a move to be closer to her DS/DD/Gkids or to handle maybe one level living (their current home is 3 levels - with no bedrooms on main level and only half bath on main level).

Sister took her longer time career job in small college town in IA after her DH (16 years older than sis) retired from ministry; she was a school librarian - masters in library science and kept up with all certifications for teaching K - 8. This is the only home they have owned; laundry is in basement but she can give up a closet for stacking W/D when no longer wants to deal with basement stairs. She loves the extra things that the college town offers, and is very involved with recreation (pickle ball) and gym/exercise classes where she can ride her bike around to these things on good weather days – safe bike riding and very close. Chose the house location to fit their ‘criteria’.

DH’s cousin bought a home (they chose the details) in their 55+ community near San Antonio TX. Their DD/SIL don’t live far, and none of their married kids have children. They have a RV, and will continue to travel with RV as well as enjoy the amenities and friendships in senior community.

55+ community is not for DH and me at our current go-go or slower-go years. Who knows a lot further down the road.

Agree with @Ivvcsf "I want a place where I can afford to live, I have good access to medical care, I have access to the arts… music, plays, dance etc. that is reasonably affordable, I have a opportunity to meet friends and finally has access to reasonably affordable airfares ". We pretty much have all of that now, although to get to one DD from our airport with reasonable airfare is with one airline (American Airlines) - I got one credit card for miles and free extra bag, and there is now another credit card offer for 50,000 miles and will probably take that one out too. A lot of people are moving here to retire near their children/grandchildren - and we have a large enough military base with commissary and other aspects for military retirees.

I agree with you about being wary about HOA aspects of a community as well as other things specific with 55+ community.

Nothing is ‘pushing’ us to move, and DH is very linked in to his hobby in our current area. I have a big network of activities and social things, but I can walk away from it all once DH is able to walk away. In the meantime, to chip away at home improvements, declutter, etc. Right now, some gardening work - my front step pots and some perennials to add to our front of the home ‘curb appeal’. Next door young family neighbor is working to achieve the beautiful lawn DH has - and he will get there (hired lawn feed/weed control and he mows himself).

Re moving in retirement, I’ve taken lessons as to what not to do from my in laws. So far in retirement over a span of 15 years, they moved from our city to Texas because they were fed up with our city. Then they missed us and their friends and even our city, lol, so they moved back within a few years. Then despite living mere blocks from us and seeing us and their grandkids several times a week, they decided to move to the Mississippi Gulf Coast. Then when ailments made living alone impractical, they moved to Texas again to an assisted living facility. After a couple years they still talk about moving back to our city, and wish they could live where they were in Mississippi. They move for emotional reasons, which I realize are a big part of it but when allowed to dominate result in some poor financial choices.

Sounds like they ignored what could happen health wise in declining years. They could have done some extended stay rentals instead of their full moves. Typically when two people are making decisions, one often might have a more practical hat on - or at least think about some of the options that can help preserve one’s nest egg better.

Well that’s one way to get decluttered. Ha, not the preferred method.