We have had dental insurance through Delta Dental and maybe others over the years. Never seemed to be all that valuable. It does reduce the costs somewhat if there is an expensive procedure and gives us the two (?) teeth cleanings a year.

This article is interesting as it relates to the liquidity of our home real estate investments.

I was hoping the housing market is moving - as we’ve had listings galore where I live and they’re moving quick - but well under asking - like people are taking the first offer no matter the price.

We have a manager leaving this week after 20+ years. No idea what is next.

But boy, all these articles and the folks on the job threads board whose kids are struggling, it sure seems real even though we’re being told by the president - things are great…it’s just the data is wrong.

It’s crazy how it’s slowed so quickly…hopefully for the kids it will get better.

The part of people can’t move - either up or down - that’s a bit scary too.

Ultimately, I want to downsize - but I’ll likely have to hit a lower cost part of the country to do so. Where I live is very pricey.

Thanks for sharing.

Article this week about older Americans deciding to rent instead of own when they downsize.

I’ve been thinking about this.

I paid off my mortgage last year - then paid $40K for a roof. Now just paid another $10K to repaint dormers and some other things plus $2100 to replace an AC coil.

Maybe I sell, take the principal, invest in a muni bond, and rent a place with the interest…

Certainly has me thinking.

I’d have a nice gym too…

My husband really loves yardwork and home improvement projects! We are staying put for now. ![]() Plus, I have never had a rental where I could paint my walls as I wished or hang pictures and art as I wanted. Most rental agreements prohibited that. A small nail in the wall was ok… a wall hanging requiring drilling and special hangers - not. Maybe in 10 years I will not care about that stuff. I do now!

Plus, I have never had a rental where I could paint my walls as I wished or hang pictures and art as I wanted. Most rental agreements prohibited that. A small nail in the wall was ok… a wall hanging requiring drilling and special hangers - not. Maybe in 10 years I will not care about that stuff. I do now!

ETA: it is all about priorities. Someone who wants to travel 2/3 of the year will be better off in a rental.

We downsized to a rental. Neither of us had ever lived in an apartment before. I was really unsure about how we would feel. Guess what, we like it. We have been able to decorate as we want, but I am easily pleased, so the carpet, flooring, and wall colors are fine for me. (BTW no issues with drilling holes for stuff like the TV supports.) My husband is delighted that he never has to go to Home Depot again. When the dishwasher broke, the drain was clogged, etc. we just filled out a maintenance request and somebody else had to take care of it. We have a nice gym, access to a community pool, community events (like book groups, sip and paint, etc.), a public lounge, an outdoor shared patio, and even a community grill! It feels just as much like home as my former house did.

Not my cup of tea, but glad you found a rental you like. Hope you continue to have a good experience living there!

Here are the downsides of apartment living. To me, waiting for a maintenance guy to come in is a PITA. A time window as wide as 4 hours? And then they are late? No thanks. Plus the mandatory periodic inspections of this and that… Neighbors’ dog barking all day long, neighbors smoking something stinky on the lanai below…. ugh. So if we ever rent, it will not be a unit in a multi story building. Oh, and a hard no to community grills. I want to serve my food hot off the grill on my own lanai. So a rental must allow grills on its lanais.

Renting introduces significant economic uncertainty IMO, along with significant life stress as we age.

That $2500/month nut might be affordable now, but in 20 years when rents have tripled, will that still be true? Particularly on a fixed income.

And how hard and stressful will moving to another place be when we’re in our 80’s or older? Especially if the kids aren’t local? And if the move is to a cheaper place it probably won’t be as nice, or in as nice an area.

I remember in our area when the condo conversion wave happened back in the 80’s, and there were horror stories of elderly people forced out of their homes they had for decades. It was ugly.

I get the appeal of “call someone else for maintenance” and “repairs are someone else’s problem”, but you pay for that in your rent, along with the increased taxes and insurance. That landlord has to make as profit…

If you are happy renting, that’s great and I hope it works out for you for the next 20+ years, but I’d rather have the security of not having to worry about being evicted when I’m 85, and the much more fixed (relatively) costs. Not to mention the neighbor issues mentioned when you share walls with your neighbors.

I’d bet money that we end up renting instead of buying in our next move, wherever and whenever that is. We’ll get a taste of that when we start splitting time between here and one/both of the kids, probably in a couple of years. I just can’t see committing to another home.

Very valid points. We moved our kid a couple of times in the past few years because the landlord sold. Not something I’d want to do any time soon.

Our property taxes and insurance are about the same as a rent for a one bedroom apartment without any bells and whistles. Of course we can invest the $$ from the sale and possibly amass a good amount for the kids to enjoy when we are gone, but at this point, we are more interested in our quality of life than chasing $$ while sacrificing.

But different strokes for different folks!

There is still a notable “golden handcuff” effect, with people being reluctant to give up their old 2-3% mortgage for a new 6-7% mortgage. Persons with old mortgages often can’t buy an equivalent home, if they sell and take on a new mortgage at the much higher rate. The lack of persons selling homes also allows prices to remain high following the post-COVID housing bubble, in spite of the increased mortgage rate.

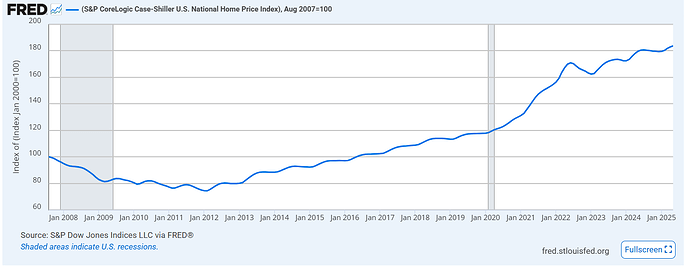

Your region does not sound like the norm in this respect. A graph showing Case-Shiller home price index is below. Housing prices as a whole are not decreasing. Median days on market also has not had large changes. The combination of high housing prices + much higher mortgage rates than when federal funds rate was 0% (much of past 16 years since GFC) makes housing especially unaffordable for first time buyers.

It may be that people are listing high…because i’m surprised these units move after a week…but my neighbor asked 1.125M and took 1.05M. And another was listed at 975K and sold 923K…both in a week (I think 6 and 3 days actually). Blew my mind someone would grab an offer that quickly.

It’s astonishing - and if you look at a return over 18 years or so, these homes have appreciated 4% or so a year - not counting commissions and improvements.

Not a great investment…

18 years ago was 2007 – just before the subprime mortgage crisis sent home values plummeting and not a great time of purchase for home appreciation. Case-Shiller for the past 18 years is below. Note that it took 9 years to recover from the home value decline following subprime mortgage crisis, and there was a large 50% appreciation over the past 5 years since COVID. Across the full 18 year period including both events, the annualized appreciation was 1.84^(1/18) = 3.4% – roughly the same as 4% you listed. If the purchase instead occurred at the bottom in 2012, the annualized appreciation would have increased to (1.84/0.74)^(1/13) = 7.2%.

Of course many individual markets differ from the overall US average used in this graph. I live in a region where the 2000s and post-COVID housing bubbles were especially severe, as was the home value decline following subprime mortgage crisis. When I looked for homes in 2009, in some neighborhoods there were huge numbers of homes for sale as short sales with seller underwater on mortgage. I bought my home from a guy who owed >$300k on mortgage above selling price, not counting the >$100k of AV equipment that came with sale.

Looking up recent sales in my neighborhood, I see a different pattern from your neighborhood. There are few listings and few home sales. The few sales that do occur tend to occur quickly after being listed, often for above asking. I suspect there is a bidding war for the limited inventory. For example, one of my neighbors purchased their home in in 2021 for $1.6M, then sold last month for $3.0M. It looks like a basic home between 3000 and 4000 sqft, with little property and few, if any upgrades. There is currently only 1 home for sale, among the many hundreds in my neighborhood grouping. It’s unclear to me why this particular home is not selling.

So back to topic, DH is retiring from his current job at the end of the month. He just had a conversation with HR about his benefit package and how it will pay out over the next year. Now we have to meet with the accountant because we also have RMD coming up. Have to figure out how much we have to pull in order to avoid any penalty. He’s still not planning to take his Social Security so I’ll be paying for his Medicare and Irmaa and supplemental and dental (the latter 2 will auto pay). Still kicking around the idea of getting an individual eye plan but I haven’t decided if it’s worth it. It would give a little bit towards glasses and all of the extra lens costs, but I don’t need new glasses now so it’s not urgent.

Many of the points in the article are very true. The young man who did get a job in DFW area (which is where ‘home’ was - GF and free housing while unemployed) - yes, it made sense for him to wait it out and get a job in DFW. I have known several young adults who have taken jobs in CA and eventually moved to where they can both have jobs and a house and a life (Atlanta). IDK if it took having a certain level of professional job experience, or how the job market worked for them. One gal who has a master’s in Biomedical Engineering (BME) - the CA wildfires was the last straw (and how water was being managed to have made the fire damage a lot worse). She now has a high quality of life because she can do things and not have so much money go to rent - and has a big network of friends and familiarity because her job is back in the state she was raised and when to college. Several other friends’ kids still live in CA but are not homeowners - many are single, but I do know a couple, both have BME degrees, and they had their own home in WI but both traveled different directions (one toward Milwaukee and one toward Madison). Now they have more time together but some of their time together of course is still commuting to a job. Who knows how long that will last w/o home ownership.

At the time we sell our home, 2026/2027 is anticipated – based on the situation with SIL converting out of Army and getting career FT employment in his field as the ‘final’ point of the family being settled in their large city. They did an Army move with 4 children under age 6 and the baby was 3 weeks old, so they know what it takes for the move. They now have 5 children and do not have maternity/paternity leave softening the move efforts on their end with more paid time off with settling into home/community with the move. IDK if he will receive a move allowance when his service ends (he may not have been ‘in’ long enough - will see) but if so, it would be used for when they purchase a home - and that might be a while, to get a home they want and be able to afford the mortgage/interest rates.

In our area, there is currently an oversupply of apartments and low inventory of homes. It is a matter of supply and demand - and if someone chooses to live out far enough to have more house or can afford a home where there are other factors that weigh in like the school district and QOL w/o long commute time. Commute time is also what people are used to - and how they make their choices. There also are people who live here long enough to wait a bit for the right house/right neighborhood/right situation. We know to get the house absolutely ‘show ready’ to compete with any new construction (which will be higher priced and w/o convenience of the location, even in the school district) and have the right realtor group. We anticipate paying ‘more for less’ in new city but will sell and watch/wait for the right home in new city. For a short time we can stay with DD1’s family but can also do a rental for a while too - and we would pay DD1 to stay there which will be a win-win. They will have more money saved toward their own home. It is all about choices and weighing out choices/decisions.

What article?

There are many times I wish for some of the conveniences of a rental but Bunsen had many good points. I don’t know that we’ll ever be able to move closer to D or if that’s just wishful thinking. I spend a lot of time looking on Redfin and Zillow! We spent quite a bit on our current residence - new roof, gutters, electrical, plumbing, landscaping, painting and as a result of that work have good access to tradespeople when we need something so I don’t see moving to a rental in retirement.

We are going to tour one of the retirement communities here. Their marketing team was present at another event and it just makes sense to “get on the list” while I’m young. Then we would be able to be a bit more particular as to when we move in.

I was recently widowed and am considering whether to stay in my house or rent an apartment. I don’t plan to make the decision for at least a year ( and maybe a few years). I want to see how it goes.

House is paid off but between my property taxes and maintenance, renting might be a better deal. My late H was very handy, could do any minor repairs and enjoyed yard work. Me- none of that. Our yard is small ( city lot) but still needs a lot of work. I am a minimalist so leaving the house for a unit half this size would be fine with me. I am currently getting rid of a lot of excess stuff ( whether I move or not).

I have run this possibility by my financial advisor and he thinks it isn’t a bad idea.

The one hard and fast rule is that I stay in the neighborhood I live in now ( actually 2 adjacent neighborhoods). All of my friends and social connections are here.