The numbers may be back on the stock market but the money in my account hasn’t recovered. Pretty sure that even a big day today won’t get them there.

Perspective is always good. The S&P 500 is where it was on 9/17/24. If someone said the market will be flat over the next 7 months, most people would probably shrug.

But since it went up and then down, people are concerned. Sometimes the market is over valued and needs to take a break.

The market does not go up all the time.

My dad died last year and I ordered an appraisal of their home that same month. That way she’ll get a good number for his half of the step up in cost basis. I calculated this will save her a lot in capital gains taxes when she sells. So the amount I’m estimating for investment from the sale of her home already accounts for losing 10% in costs for selling the house as well as capital gains taxes. I also have all my dad’s meticulous records and receipts for improvements but still need to catalog those at some point. Mom’s estate attorney and accountant were both thrilled with my plans when I brought up the idea of getting the appraisal.

I’ve done the detailed calculations for taxes and senior living and all that stuff. Regardless of where she lives she’ll come out ahead selling the house. The only thing that might require dipping into additional principal would be the highest level of residential care. But it would take quite a few years of that to deplete her money and people don’t typically live that long once they hit that point.

We do our own taxes and investing because we’re both great with numbers and don’t have a complicated situation. But we’ll consult professionals if life gets complicated beyond our abilities and/or desire to DIY taxes and investments. We do consult with our workplace FAs every few years and they’re always reassuring.

I’m so excited to get into the pre-retirement mode of living our retirement financial lifestyle to see how it feels and if it’s right for us. We’re lucky that since we had kids when we did, and they’re launching when they are, we get to try out living that way while we’re still years out from retirement. It will be a good feeling, I suspect.

Being retired certainly can make downturns feel more severe. However, this is the first time I’ve heard someone say 2008 decline felt faster than recent decline. The “2008” decline persisted for 507 days from peak to trough, starting in 2007 and ending in 2009. The recent decline persisted for 49 days from peak to trough – less than 1/10 as long. I am using past tense because the majority of the decline has since been recovered. It’s not clear that the market is still in a decline.

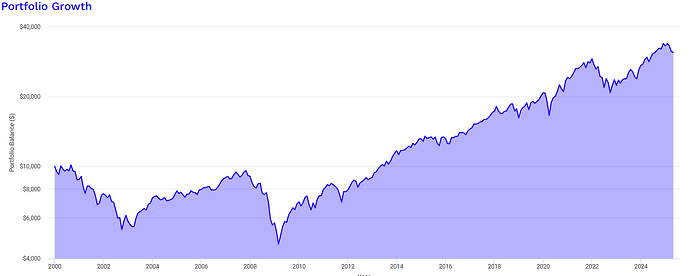

For example, the graph below shows the inflation adjusted return of S&P 500 with dividends reinvested on a logarithmic scale. The resolution is in monthly intervals, so it can barely graph this year’s 49 day decline, missing both the lowest point and the most recent recovery. However, the global financial crisis in 2007-09 is clearly visible and stands out as quite severe on this monthly interval scale.

I suspect another contributing factor to why the 2007-09 decline may not feel as severe is the nature of human memory. Remembering almost anything negative from 17 years ago feels less severe than more recent similarly negatively events. This is part of an evolutionary adaption to support day to day function. If our worst past memories didn’t feel less severe over the years, many people wouldn’t be able to get out of bed.

You have done great for your mom, and also dad’s meticulous records.

Very impressed!

I think that this is the sunny day before the hurricane

There’s a question eventually …

Had an interesting long convo with ds2 this afternoon that touched on our retirement.

We reiterated that we’d rather give him and his brother money in the the next 20ish years rather than when we were dead. He told us that it was more important to them that we spend money on ourselves. He specifically mentioned seeing how happy we looked in pictures while in Florence for our 30th anniversary several years ago. He wants more of that. Yeah, me, too! lol

We told him how much we budget annually for travel and that part of that is earmarked for helping him/SO and his brother/wife with airfare because we see that money as an investment in our family/family time. We don’t want finances to stand in the way of being together. He liked that.

So then he thanked us for being so forthcoming with our finances and how his friends absolutely don’t have these kinds of conversations with their parents, which gets to my question:

How much do you share with your adult children about your finances/intentions? Any reasons why you do or don’t share?

For us, we don’t want them to worry about our finances. We did a lot of years in a scarcity mindset, but we’re past that now. We wanted to reassure them that we won’t (we hope!) be a financial burden to them.

Two, we want them to completely understand how we THINK about money and our intentions for our estate (some charitable giving, but everything else 50-50).

Three, we wanted to use the retirement discussion to further instill our values around money, such as living below your means, and prove that you don’t have to make a bundle to have a healthy retirement.

What about y’all?

ETA: I have a good friend who is a CPA who doesn’t talk to her kids about her money at all. I didn’t ask why. I save that kind of thing for y’all.

We told our kids about our finances.

And now D24 wont stop ordering Door Dash every night.

haven’t really told kids much about our finance amounts, other than they get what ever is left when were gone, and where to look for the files. No reason in particular, just never comes up.

Your approach sounds so nice and your kids clearly appreciate it. My parents made me feel very stressed as a kid when they freaked out about money, and they often argued. We’re open about our finances with our kids, but we never say anything to make them feel worried or insecure. We are relaxed and not emotional about any of it around them. It helps that my spouse and I never argue about money (thank goodness).

Our openness has been partly by necessity with our college student, because it’s been a true family effort to plan his finances, and we use nearly all his earnings to pay for his college expenses.

My kids (still teens) have Roth IRAs, their own savings accounts and checking accounts with debit cards, and are authorized users on our CC. They know they can’t touch the money in their Roth or savings for now, but can spend their checking account money (20% of what they earn, plus any gifts) on whatever they want, using their debit cards. They only buy approved things on our shared CC.

My mom was bad with money and my passive dad just did what he could to stem that tide – things luckily turned out okay for them. They weren’t a great example. They did teach me to always pay your minimum payment on time and watch your credit score but not much else. My sister and I marvel at how we both learned to be financially responsible on our own because it certainly didn’t come from them. I of course had to take over my mom’s finances after dad got dementia because she’s never been capable.

My spouse’s parents are well-off but didn’t educate their kids on money very well, nor did they pay for college even though they could afford it ARGHHH. They took 100% of my spouse’s earnings for college expenses and almost all the rest was financed with loans in my spouse’s name, including high-interest private loans. So that was not awesome. We married at 21 and already had a crapload of student debt. My spouse (a lean college athlete) lost so much weight when we married because we couldn’t afford food. I worked 3 jobs at once.

However, my FIL did tell us to never leave the any part of a 401k employer match unclaimed, so we were socking money into retirement even when we barely had 2 nickles to rub together and were neck-deep in student loan repayments. That more than anything has saved us. But it smarts a little to see them with millions and millions of dollars that they didn’t consider worth spending on their kids’ modest education expenses. Oh well, it’s their money to do as they see fit! They don’t tell us much about it, but we have a copy of their trust. We know approximately how much they expect to leave their kids but we don’t factor that into our calculations at this point.

We made both our kids take personal finance in HS, and we actively educate them on how to manage money. Part of that includes being open about our own finances and priorities since it’s been such a struggle for us to stay afloat over the years. Maybe if we were rich, we’d be more opaque since we wouldn’t want them to necessarily know that.

We’re determined not to let our kids make some of the same mistakes we made, and we don’t want them to struggle to pay their bills. For our family that means a lot of talking with them about money, since our budget is so tight. I imagine we’ll continue to do this into their mid-20s at least, and beyond if they want our guidance.

We’ve been relieved and impressed so far with their maturity with money and jobs and we hope that trend continues. They are already way better off than we were at the same ages. It’s been lovely to see them grow up and I’m optimistic that we might soon move into an era where we all have enough to do some fun new stuff together.

I told ds2 that a lot of people with money don’t tell their kids, because they don’t want them to lose initiative. But he said that his friends, some of whom come from wealthy families, don’t know anything about, say, Roth IRAs. Teaching your kid about finances doesn’t mean you have to divulge your own.

Recently, one of the group held a “Roth IRA Saturday,” where they all met at one house and opened Roths. ![]()

On a recent Dave Ramsey clip I saw, a family that had won a huge lottery payout, stated that they weren’t telling the kids because they didn’t want the kids to become “waiters” - i.e. waiting for us to die…

Dave found this description hilarious, but understood the logic.

Everything. Part of teaching our son to build his own wealth was including him in the building of our own. That included introducing him to our FA when he was very young so she could begin educating him on investing and helping him build a portfolio from his savings. He is our only child; we withhold nothing from him.

However, although he obviously knows what we have and that he inherits whatever’s left when we pass, he doesn’t know about the significant inheritance he will receive from an unexpected source. We and the source have chosen to keep that from him.

Fingers crossed that you are withholding this info from me, too! ![]()

What? You mean point out that we are worth a whole lot more dead than alive? Just kidding. Our kids know we are doing fine and generally must realize they could get decent money if we don’t have excessive LTC expenses. We do try to share money with cash gifts now, but they really encourage us to spend money on ourselves. As does the FA, who is always makes time to hear about our travels, car purchase etc.

Although we have not shared details with kids, we do feel that the organization and simplification we’ve done in recent years will ease their logistic burdens someday if there is money left over for them. Hubby maintains a splendid 1 page snapshot overview, including investments not visible to the FA.

I keep thinking that we should do that – write down exactly what we have and where and passwords and such. I do feel like we are pretty streamlined at this point, but I bet we could make it easier still.

Our kids know they don’t need to worry about our finances now. We haven’t shared every dollar detail, but they know we can easily pay our bills…now.

They also know how our retirement money was established…so they can do the same.

Well my older S has been my backup for running our household since he was in middle school. He was more capable than H, who wants absolutely nothing to do with it. So I shared with him my what to do if I die document that has anything and everything one should need to keep our house running. I’ve since also shared it with younger S. I regularly send them the document link on my OneDrive. It’s also printed out as a hard copy in our safe. I told H this countless of times over the years, shown it to him, etc. but if I were to pass first, he’d more likely than not have no idea it existed.

My kids are doing much better financially than we were at their age. Of course, they started with a lot more in the bank and their jobs are much better paying even taking inflation and higher cost of living into account. Financial stuff is older S’s thing and he has also helped his brother.

I feel that maybe we’ve told our kids too much about our finances, but I am incredibly annoyed by the possibility that we could pass away and they didn’t know about an account or asset, and it just ends up in the governments hands. We didn’t work so long and hard for that to happen.

Our older son seems annoyed and disinterested when we talk about finances. Don’t know if it’s because it’s boring to him, or because he’s saved plenty already. The youngest seems to understand everything and taken our financial advice. But should someone know how much they’ll inherit? Can you help yourself from thinking about it? I don’t know the right answer.

Our ds does not know the value of our assets. I don’t know if he could accurately estimate the amount or not.

In the past he has said, “I don’t want your money.” Not in the mean way that sounds being typed out but in a, “You yourselves should enjoy your money and not worry about trying to leave me any,” way.

Things are in place for him to know what we have and where it is if we were to both die simultaneously. I wouldn’t have any issue sharing specifics with him now, but he doesn’t seem to want to know.

I am much more comfortable talking about such things than either my dh or ds is. Part of this is from my own personal experience of having lost both parents simultaneously at a fairly young age and part is from taking a class on estates in law school. Dh knows all of his mother’s information as he handles her investing for her (not her day-to-day expenses or bills). His sister also generally knows mil’s financial situation, though not in as much specific detail about allocation of assets, etc. Mil had no idea of the assets she and fil had until he died. Fil was very patriarchal about managing the money. Even though she made slightly more than he did, he controlled their finances. I really can’t give him the descriptor, “frugal,” as he was just plain stingy and cheap.