I don’t either. Ultimately whether the product a given college delivers is worth more, less, or about as much as the cost it takes to deliver it is one of those very personal, aka subjective, decisions.

I usually just google something like the name of the school and “financial statements”. Typically I have quickly found informative documents. But determining a spend per student is not necessarily uncontroversial.

That too, but it is interesting to think about why they would not have collectively exerted more competitive pricing pressure on these colleges, if hypothetically they did not like the terms of the deal. Perhaps it is a collective action issue. Perhaps it is collusion by the colleges. Or perhaps they have leveraged the fact that their continued patronage is de facto a big part of how these institutions perpetuate themselves over generations to get themselves a very good deal.

Again whether or not it actually enhances the student experience is a potentially personal issue. But we can look at their budget documents to see what is actually happening.

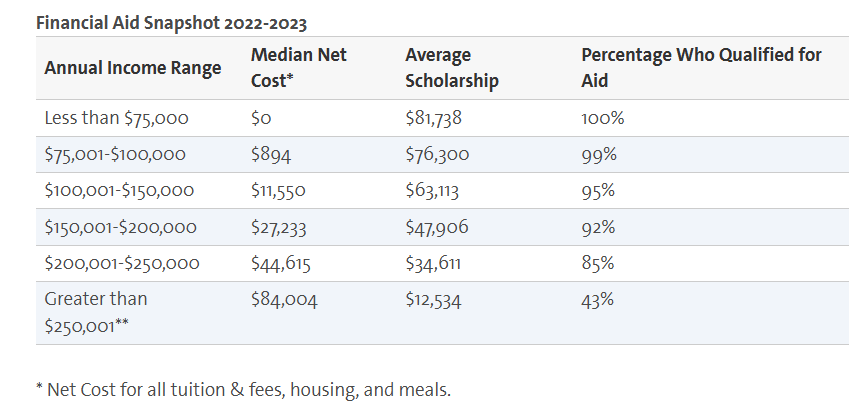

OK, so here is Haverford:

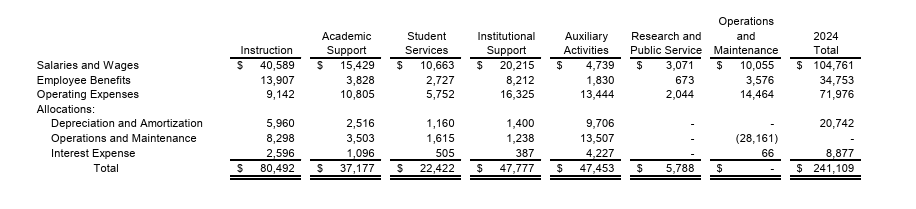

Swarthmore:

Focusing just on the operating budget, Swarthmore in FY ended 6/24 had total operating expenses of $241,109,000. That was spread over around 1641 FT students (and 3 PT, but that’s confusing), so about $147K per student in operating expenses. Again this doesn’t include capital expenses aside from depreciation and interest on debt.

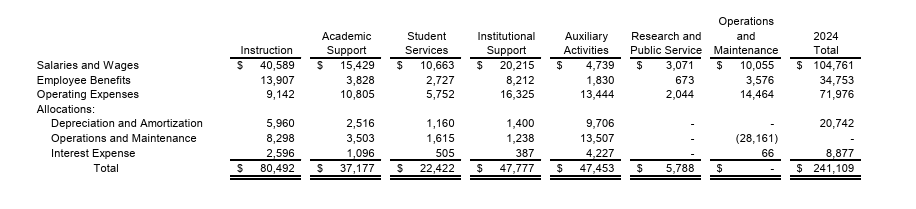

Haverford had $127,177,000 in operating expenses, about 1419 FT students (and a few PT I will again ignore), so about $90K per student.

Looking at the categories, by far the biggest contributor to that approximately $57K/student difference was salaries and benefits. If you do the math, Swarthmore spent about $85K per student that way, Haverford about $53K, so that is $32K right there. General operating expenses was then about $44K to $26K (+$18K), depreciation was $13K to $7K (+$6K), and interest was about $5.4K to $4.1K (a little over +$1K).

Pausing, this is pretty typical from what I have seen, meaning a lot of the additional spending by the wealthiest colleges goes to salary and benefits.

OK, so what is actually in those categories? Well here is comparable charts from the Notes. Swarthmore:

Haverford:

The biggest overall category at both is Instruction, and it is particularly big in salary and benefits. That is one large chunk of where Swarthmore spends more. There is also a big difference in Academic Support, Auxiliary Services, and finally Institutional Support. In contrast, they are actually quite close in terms of Research and Student Services.

What is all that stuff? You can’t really tell from these documents, and I have not tried to dig down further for these colleges.

I am reminded of when the 8th grade families at our K-8 only private school toured local HS options. As to one of the most popular schools (which ended up our own S24’s choice), a joking-not-joking meme developed: “at least you can see where the money went.”

I know a lot of people’s initial reaction to all this is skepticism, but to be clear about the real world mechanisms, I am not suggesting a lot of families are digging into financial statements and calculating leverage rates.

But I do think in many, many ways, these schools find ways to communicate to their target market “this is where the money went”.

Again I am not sure the data I have seen actually supports this narrative. It certainly didn’t back at the time of the Chetty Study/NYT data, meaning there was no indication of an unusually low matriculation rate in that range.

Yeah, long ago my first deep dive into all this was surrounding our planning when our S24 was just an infant (and already by then, the concept of a donut hole was popular).

The consensus among the people who seemed to know what they were talking about (always a controversial topic itself) was basically that assuming relatively decent investment returns over a long enough period of time, those returns will likely outstrip the marginal decrease in aid. Like the typical assessment rate is something like 5% annually, and in most longer-term scenarios you should easily be able to cover that out of returns.

In other words, long term college savings worked in the sense you would indeed be better off financially after paying for college having saved that money, although of course that is not putting a value on what else you could have done with it if you didn’t save it.

I note another consensus takeaway was you should usually save in retirement funds first, since they were typically not assessed. Something like a 529 could be a good idea, though, if you had already maxed out retirement funds.

But then psychologically? My two cents is it is relatively easy for people who have savings in 529s to go ahead and spend those on college. But even if you have the same overall savings, if more of it is in retirement funds, or net home equity, or something else not so obviously earmarked for education, some people may find it harder to write those big checks.